- eBay UK Community

- Discussion

- Selling

- Business Seller Board

- HMRC exemption certificat for VAT - Sole Trader un...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 11:01 AM

Hello,

eBay restricted my sale, preventing me to put anything on sale, as they ask me a UK VAT registration number.

That said, I am a sole trader, and my yearly turnover is under £85 000, meaning that I have not to enroll to the VAT program.

I did rise the matter to eBay that, even aknowledging my statement, says that they cant do anything unless I provide a "VAT exemption certificate from HMRC".

Research done, HMRC do not in any case provide such certificate for sole trader under the threshold.

Basically eBay is asking for a prove I am not VAT registred because I have not to be, and HMRC do not provide such document.

I went full circle with eBay customer service few times, always ending with asking me again me that non-existing document, or say they are escalating the matter with a 48h-72h answer time (meaning being let alone and without further contact with them).

Ebay was provided with my full tax return for the last fiscal year, but not sure they even looked at it, even if it shown my turnover < threshold, black on white.

I am on a Kafka logic loop.

Anyone have been on that situation ?

Thanks

- Labels:

-

VAT

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 12:32 PM - edited 20-04-2024 12:40 PM

What exactly have Ebay asked you for originally?

Have you actually checked your turnover as it runs 12 months prior to today (ie a rolling basis) and not April to April.

As an aside, your listings appear to me in Dollars, so do you have things setup correctly on Ebay itself?

Have you spoken to an accountant about it? I'm not that familiar with the rules surrounding places like Shetland, as they are different, though similar.

And on separate note, you should NOT have a web address for your website on your listings. That is effectively diverting sales from Eby and is against the rules.

And adding again, I've just had a quick look at your sold items. On the 14th, you sold about 50 items. Even being generous with that, at £10 a sale, (though some are much more and some less), that equates to a single days sales of £500. Now you may not do that every day, but if that is an average day, that means your yearly sales are a lot higher than the VAT threshold!

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 12:56 PM

Shetland is within Scotland, in the United Kingdom. So Scottish personal tax rules apply and UK business tax rules apply.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 1:09 PM - edited 20-04-2024 1:10 PM

I'd keep trying. Also try emailing and even writing to the UK head office in Richmond. Make your emails 'to the office of Murray Lambell' (General Manager - but check he is still in the role). They do have staff there and I've found them to be most helpful.

First though check your sales. You have to be under the threshold - now £90,000 - in a rolling 12 months, if you are over, you will have to register by the end of the month following the date you went over. If you went over because of certain unusual circumstances (ie a very large value sale of very large value sales are very unusual ) you can register and then de-register, which will produce a document from HMRC confirming deregistration.

If you are close but not over, send the info in the letter. If you are likely to go over, and you have worked out it is more advantageous to not be registered, have a break.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 1:15 PM

Hi did you get this sorted as I'm in same situation but my sales are not even close to vat registered requirement

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 1:31 PM

It is indeed, but the rules are actually slightly different. Though overall, very similar.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 2:31 PM

Not sorted, at the moment I still try to have eBay to aknowledge I am under the threshold, by far, and that HMRC is in no position to offer me any paper to certify that I dont have to register to VAT.

Kind of stuck.

Not looking at any other document that the one they want, and the one they want does not exist, cant be generated.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 2:35 PM

Hello,

and thank you for your answer.

Yes i have checked, and regardless if fiscal year (6th april year n to 5 th april year n+1), civil year, or the past 12 month, i am not even close to the threshold of £85 000 that they indicate in their email, and so not either to the £90 000 updated value.

Not close to go over, and cannot stop as this is my main activity (and i checked, my side sales not makes me go over the threshold either if added to eBay turnover).

They seem to follow a script and ask what they are said to ask, without listening...

Still figuring how to be heard, as i should not be the same in a similar situation.

But thanks for the advice.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 2:39 PM

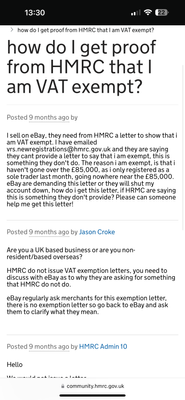

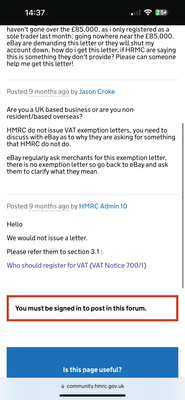

I saw this post and HMRC responded and they said it doesn't exist and they asking for something that doesn't exist

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 2:40 PM

I am well under the threshold, all sales (eBay or other combined).

The question is : why eBay do not want to listen and aknowledge that you can be sole trader, business seller on eBay AND not to be VAT registred.

They just seems to think it's impossible, and dont want to take in consideration any document submitted, except the one they request, so-called "VAT exemption certificate". double checked with HMRC, such document does not exist, they dont do that.

https://community.hmrc.gov.uk/customerforums/vat/bccd844a-e132-ee11-a81c-002248c79814

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 2:53 PM

Yes indeed, i did see that one.

I even shared the link with the person i was talking to on eBay.

They said it was only a forum thing, and then that I had to provide myself a letter from HMRC to say they dont provide "VAT exemption certificate" to sole trader under the limit. or to provide a "VAT exemption certificate".

I actually wrotte to the HMRC address above... with no answer at all. I was more lucky on the phone, but it's not a written proof that eBay would consider.

You can see the conendrum.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 3:14 PM

There is obviously a reason why they think you need to be registered.

That is what you need to find out, which is why I asked the questions I did.

What exactly did Ebay say in the first request?

Have you checked that all of your details are actually correct on Ebay?

I know your saying that your turnover is less, but have you actually checked the rolling 12 month turnover?

This includes your postage if you charge for it separately. It is gross sales and not what you have actually received.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 3:15 PM

Are you sure you are looking at the sales figures using ebay own tool in the 'Performance' tab and then 'Sales' and not what is shown under your Seller Dashboard in the 'Transactions and sales' section? I had this issue a few years ago and was certain I was below the threshold April to April, when I looked at it using thr sales tab I was over

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 3:31 PM

Yes, I am sure. I am certainly below the limit.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 3:44 PM

They asking he for exception letter however my sales are way way way off the requirement and when I spoke to eBay they admit it's lower but they want a exception letter that doesn't exist

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 3:52 PM

No, what "exactly" did they say in the first instance?

I'm quite sure, that you never got an email just saying "send us an exception letter!"

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 4:30 PM - edited 20-04-2024 4:31 PM

I can explain what they said for me, I got a email a few weeks ago which I never even noticed, but I'll copy and paste what it says.

We value you as an eBay seller, so we wanted to let you know that the UK Value Added Tax (VAT) information on your eBay account is either missing, invalid, or displayed incorrectly. You need to update your VAT details right away or your account will be restricted from selling on eBay.

HMRC requires eBay to make sure any UK established business that generates more than £85,000 revenue in the last rolling 12 months holds a valid UK VAT number. Learn more about your VAT obligations in the UK.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 4:58 PM

Ok, so they think that you are reaching, or have exceeded the threshold.

The question is why?

Have you actually gone back and triple checked your figures?

There is obviously something that is adding up incorrectly.

Do you have many foreign sales, as the tax on that is worked out differently for threshold purposes.

It's also possible, though I'm not sure how they work it out, that if you use GSP, they are adding that cost into your turnover.

Is there anything on your account, that makes them think that you are not UK registered?

Interesting that they still haven't updated that, to allow for the new threshold.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 8:56 PM

The core of the problem is, as for vwgolfman333, that they sent to me a generic email stating :

"HMRC requires eBay to make sure any UK established business that generates more than £85,000 revenue in the last rolling 12 months holds a valid UK VAT number."

Absolutely fine.

But by any figure, any angle you want to look at my turnover, it's under that limit. Under, neat and clear. You can doubt it, say that eBay have reasons to send me this email according their figures, but not change the fact that I am under regardless.

The core of the problem is for me : they dont look at anything, any argument, any document sent. they not reject them, they not discuss them. They just ask, in a loop the "HMRC exemtion certificate for VAT".

And my question is, how do I go over that loop.

HMRC exemption certificat for VAT - Sole Trader under £85 000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

20-04-2024 10:40 PM

I can guarantee mine isn't even close, I don't really sell anything abroad, my sales was not even half the vat registered requirement and when I spoke to them they said I am below the threshold and they acknowledged that but I need to get a exemption letter from HMRC, that's what they told me and now I found out you can't get a vat exception letter