- eBay UK Community

- Discussion

- Selling

- Seller Central

- Vinted have updated their T & C's with regard to H...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

23-04-2024 1:56 PM - edited 23-04-2024 2:04 PM

Sent under cover of an email 22nd April:

"2.8.3.To report your earnings and taxpayer information

If you reach a certain amount of sales or earnings, we are obliged to collect and report your earnings and taxpayer information to HM Revenue & Customs (HMRC). This is a legal requirement under the Platform Operators (Due Diligence and Reporting Requirements) Regulations 2023.

For more information, please read our Help Center.

If this applies to you, we will collect and use the following data for reporting purposes:

1. Full name;

2. Primary address;

3. Tax identification number (TIN) and place of issue;

4. Date of birth;

5. Residence country for taxpaying purposes;

6. Sales revenue per year;

7. Number of transactions completed per year; and

8. Financial account identifiers (e.g. bank account information). "

The Help Center link works

- Labels:

-

Sales

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

23-04-2024 2:04 PM

Interestingly no N.I. number which ebay specified, and HMRC warns everyone against sharing that number with any one.

Still not sure how fragmented sales on a variety of platforms will be consolidated - some of that platforms are none UK based, and as such may not be obliged to participate.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

23-04-2024 2:40 PM

@a45heaven wrote:Interestingly no N.I. number which ebay specified

A NINO is a tax identification number (TIN).

@a45heaven wrote:HMRC warns everyone against sharing that number with any one.

Not quite; HMRC warns "To prevent identity fraud, do not share your National Insurance number with anyone who does not need it". eBay will need NINOs from individuals who reach either reporting threshold. In fact, eBay (UK) is an "authorised financial service provider" - you can see their entry in the Financial Conduct Authority Register here.

Are Vinted on the FCA register?

@a45heaven wrote:

Still not sure how fragmented sales on a variety of platforms will be consolidated - some of that platforms are none UK based, and as such may not be obliged to participate.

They're consolidated through tax identification numbers (such as NINOs or UTRs). The rules weren't created by HMRC; they were laid down by the OECD (an international organisation). All member countries follow the same rules; if the platform is registered in a member country they still need to comply.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

23-04-2024 2:59 PM

"authorised financial service provider"

i thought ebay got round that by having 'Adyen' front the finance side?

Id still prefer to have HMRC tell me to release info to another body, even if that body was reliable.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

23-04-2024 3:27 PM

@a45heaven wrote:"authorised financial service provider"

i thought ebay got round that by having 'Adyen' front the finance side?

Adyen are just ebay's internet merchant account provider; i.e. they enable card and PayPal payments to be paid into eBay's bank account. Sellers receive their funds from eBay Commerce UK Ltd; as per eBay's Payments Terms of Use:

"You authorize ECUK to acquire and settle payments that it receives on your behalf. When you sell an item on eBay, you are deemed to be a payee, with ECUK acting as your payment service provider. In a refund, chargeback, or similar scenario, or if you use your funds to pay, you may be deemed to be a payer, again with ECUK acting as your payment service provider. If ECUK is your Payout Entity, ECUK will open and hold a payment account for you."

@a45heaven wrote:

Id still prefer to have HMRC tell me to release info to another body, even if that body was reliable.

HMRC state it's OK to disclose your NINO to an authorised payment service provider if they require it; the link to check if the payment service provider is authorised takes you to the FCA Register's search page.

All PAYE employers require the employee's NINO so the employee's income tax and National Insurance Contributions are recorded correctly. The vast majority of employers are companies that aren't regulated in any way other than under the Data Protection Act (GDPR). Would you be equally as concerned about disclosing your NINO to a new employer?

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

23-04-2024 3:48 PM

what was the name of the new fee ebay announced last month in order to supply the info ? and did they decided how they would reap it from sellers?

eBay Commerce UK Ltd

yes it changed quickly to that from adyen, with little notice as to why.

Would you be equally as concerned about disclosing your NINO to a new employer?

No, but ive only ever worked for more reliable entities which are not constantly having security issues as is the case here. ebay can never be described as being consistent or problem free, unless constantly problematic.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

23-04-2024 10:29 PM

Vinted have updated their T & C's with regard to HMRC

Yes, along with other online sites who have also got to officially come in line with the new reporting of sales R&R's........

Absolutely nothing to worry about for those who are genuinely selling their personal items and not buying to sell as a side hussle. With the exception of a single item sold over the set amount of your personal CGT allowance, of which would need to be declared to HMRC.

You may think you have pushed ALL my buttons, but you still haven't found the mute!

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

24-04-2024 9:21 AM

A question.

When registering with ebay as a business seller does ebay ask for the sellers' UTI, their NINO, or both ?

Before I retired I was registered as a S.E , Sole Trader and HMRC gave me a UTI for tax purposes. My NINO was also on their records to ensure that my NI payments were credited to my contributions account with DWP, NOT for use as a Tax Identification Number.

Personally I'd be far happier about giving ebay my UTI (if it it is still operational) as it is definitely unique to HMRC and my tax account and is not used for I.D anywhere but HMRC.

My NINO is used on bank accounts, savings accounts, pensions and wages and I think whoever decided that handing it over to any selling platform that asks for it is not acting with any regard for my security. Particularly when they are mostly US Corporations that are well known for doing whatever is in the best interests of their bottom line, even when their actions are against the interests of their sellers.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 7:56 AM

Hmmm, no answer ?

I wonder why ?

Perhaps I should have added "or neither"?

Surely one business seller or Mentor remembers what info. they gave ebay when they became "properly registered" ?

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 8:56 AM

It was a long time back that I registered as a business, but I don't recall givng ebay my UTR. I may have done, or even if I didn't then, things may have changed, and it may be required now. I'm pretty sure I never had to give them my NINO.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 9:02 AM - edited 25-04-2024 9:06 AM

No you do not have to give your NI number or UTR NUMBER when registering as a buisness seller.

My guess is that ebay will hold back asking for this info for as long as possible. Genuine buisness sellers are looking fwd and hopeing for a level playing field. Time will tell, "hobby sellers" will be a thing of the past.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 9:45 AM - edited 25-04-2024 9:49 AM

Thanks for your reply. Like you it was long ago that I registered, in my case as a private seller and like you I don't recall being asked for my UTR (which I had at the time) and I'm also almost 100% certain that I wasn't asked for my NINO.

As I said above, I understood that my TIN was and is my UTR and that HMRC required my NINO to ensure that my NI contributions were credited to the correct account, not as a TIN. If it was used as a TIN, why issue a UTR at all ?

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 9:47 AM - edited 25-04-2024 9:48 AM

Every platform will be updating its T&Cs with HMRC in mind.

All them no exceptions.

You cant move elswhere to hid from this.

If your a business you need to update yourself or risk getting investigated and a big fine.

All you second hand seller with 1000s of listings,think can my arguments on ebay forum that im selling my own stuff hold up to the sctutiny of HMRC.

Good luck to all most of the private/ business sellers are going to need it.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 10:16 AM

Thanks for your replies.

Why I asked the question is that the Vinted UA update doesn't mention NINOs or UTRs, only TIN and I wonder if ALL sellers will be required to give ebay there NINO ? Or will business sellers be able to give their UTR while private sellers will be required to give their NINO.

As I said above I'm reluctant to give ebay my NINO, but happier to give them my UTR because it is unique to HMRC and not used as an identifier anywhere else (like my life savings !)

If every sale I make on ebay is to become suspect and subject to HMRC scrutiny for tax purposes, then I want the extra security that a UTR gives and enables me to keep my NINO as private as possible, not handing it out to any US corporation that asks for it.

I'm sure that as you say there will be another exodus of private sellers when ebay asks for one of the last pieces of private information that it doesn't already have. Not just "hobby" sellers, but any private seller with any sense and I will be among them.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 10:23 AM

Im not holding my breath - curiously, how will this affect the none UK sellers from different lands offering up cheap stuff / copies etc - which is one of the sellers main issues?

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 11:11 AM

eBay state that private sellers and sole traders will have to supply their NINO. At a guess this is because they're unable to define their end who is completing a self assessment and has a UTR, but everyone has a NINO. They could design a simple webform that just asks though.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 12:00 PM

From the 'Help Center' link:

"If you reach the criteria for reporting, we’ll reach out to you by November 2024."

Mindful it says 'by', but are they going to leave it as late as they dare to get as many sales as they can in the interim. Will eBay do the same?

Interestingly under 'Good to Know' they say:

"Learn more about why your sales aren’t taxed when selling second-hand"

Ironic as they have loads of unregistered businesses on there selling 'second-hand'. Are they trying to con them they will be exempt?

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 2:12 PM

eBay have previously asked to see evidence of my tax returns including UTC, NI no, name and address and proof of submission. I've had to provide for the last 2 years.

They have allowed the actual amounts to be hidden.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 2:34 PM

@a45heaven wrote:curiously, how will this affect the none UK sellers from different lands offering up cheap stuff / copies etc - which is one of the sellers main issues?

It would only affect them if whichever country they're domiciled in for income tax is an OECD member. The top "Low Cost Countries" - China (inc. Hong Kong) & India are not members.

It doesn't matter anyway. The only UK tax due from such sellers is VAT on their sales but that has been taken care of separately.

Vinted have updated their T & C's with regard to HMRC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

25-04-2024 4:53 PM

@*vyolla* wrote:eBay state that private sellers and sole traders will have to supply their NINO. At a guess this is because they're unable to define their end who is completing a self assessment and has a UTR, but everyone has a NINO. They could design a simple webform that just asks though.

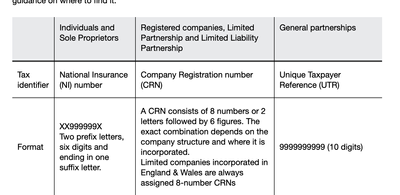

I think it's exactly that as logically it should be:

Individuals (private sellers): NINO

Sole proprietors (sole traders): UTR

General partnerships (ordinary partnerships): UTR

Registered companies (LTD, LLP, LP etc): CRN

eBay and/or HMRC clearly know there are more than a few sole traders selling through private accounts who are declaring their income in a self-assessment return. eBay would have no way of knowing whether to request a NINO or UTR from any given private seller so requesting a NINO for all "individual" sellers covers all bases. Also, if a private seller had the option of providing a UTR - and did provide one - they would be identifying themself as a trader meaning eBay would be complicit in their activities unless the seller was forced to "upgrade" their account upon provision of a UTR.