- eBay UK Community

- Discussion

- Selling

- Business Seller Board

- Who is right - (Private) business sellers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

10-04-2024 3:55 PM

With regards the long running Q&As about trying to report business sellers on private

accounts, we now have 2 answers. Who is right and who is wrong

Anita - You can report these sellers here (link) > select 'The seller has violated one of eBay’s policies' > Continue. The report goes to our Trust & safety team for a review.

Dave - Unfortunately there isn't an option for that exact topic

Looking at the options, how difficult would it be to add Business seller avoiding fees and reducing buyer rights on a private account.

Give me access to the editing pages and should take me a couple of minutes

BTW - Other in the options, I guess means not important

.

.

Astronomy is looking up

- Labels:

-

Register as a Seller

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

10-04-2024 4:22 PM

I think all options have been tried. The problem is ebay ignoring the reports however they are made.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

10-04-2024 4:33 PM

I doubt if anything will change until they are forced to do something about it.

How many millions of sellers would go if Ebay gave them an ultimatum ?.

How many millions of ££££ would Ebay lose in fee's ?.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

10-04-2024 8:25 PM

Unfortunately eBay not only do nothing about the reports, but actively encourage the behaviour.

100 free listings a month, 80% off FVFs every two weeks, free listing and fees for clothing and encouraging private sellers to open a shop....!!! The list goes on.

Just hope HMRC take most of them out early next year.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

10-04-2024 8:30 PM

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

10-04-2024 11:30 PM

PAYE for marketplace sellers? Actually, it's not a bad idea, and perfectly easy to implement.

Something along the lines of:

- if you're NOT registered as a business seller, you get charged basic rate tax on all sales after the first £1000 of sales per year or whatever the declarable limit is.

- if you have more than one private account, you can nominate the split of that £1000 allowance.

- if it's genuine private sales, you claim any overpayments back from HMRC in the same way as with PAYE. This may of course entail explaining in writing why you've sold 1000 brand new sofas or 300 pairs of skis without running a business, which may lead you to consider your trading status more carefully...

Cesario, the Count's gentleman

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 12:14 AM

@555njp wrote:Unfortunately eBay not only do nothing about the reports, but actively encourage the behaviour.

100 free listings a month, 80% off FVFs every two weeks, free listing and fees for clothing and encouraging private sellers to open a shop....!!! The list goes on.

Just hope HMRC take most of them out early next year.

It's worse than that, it's 1000 free listings a month!

Log in to my private account on the seller hub there is a link to "New business guide". Crazy. It's like, here's the option for people who just don't feel like paying fees.

[Tangent] On the subway in New York city, they have "emergency" gates which aren't locked, right next to the turnstiles which require a ticket. Guess what? People just go through the emergency gate and don't pay...

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 8:05 AM

Theyd probably not lose that much money, its not like superstore23423 who has 500 listings is just going to throw all of their listings in the bin, theyd still sell them, multiply that by thousands. Also the buyers are still going to be here, so if they cant buy from superstore23423 they might buy from you or I if we sell the item they are looking for.

@555njp HMRC will catch 0.1% at most, the real culprits arent stupid enough to not pay tax, it'll be thousands of letters being sent out to people who have sold 50 pieces of clothing all used, all roughly the same size and all the same style (as in a teenagers style or a 50 year old punk rocker style) who arent actually businesses just a family thinking better to get a few hundred quid for my old stuff s times are hard.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 8:12 AM

They won't send letters to those people. That would be a complete waste of resources.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 9:47 AM

All giving another option to report would achieve is to give them another option to ignore.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 9:52 AM

As business sellers, we should simply not buy from anyone with a private account yet clearly a running a business. It's not much, but I feel better about it! And it's worth messaging the seller to explain why you have not purchased from them. I was looking at an expensive set of step ladders, but chose to buy elsewhere when I saw the dreaded "Private" on the listing. That's all we can do. Reporting has no effect, so don't bother.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 10:23 AM

It's worse than that, it's 1000 free listings a month!

yes I know, sorry, forgot the extra nought! Time I spotted it was too late to edit 😂

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 10:36 AM - edited 11-04-2024 10:38 AM

@bravergrace wrote:PAYE for marketplace sellers? Actually, it's not a bad idea, and perfectly easy to implement.

Something along the lines of:

- if you're NOT registered as a business seller, you get charged basic rate tax on all sales after the first £1000 of sales per year or whatever the declarable limit is.

- if you have more than one private account, you can nominate the split of that £1000 allowance.

- if it's genuine private sales, you claim any overpayments back from HMRC in the same way as with PAYE. This may of course entail explaining in writing why you've sold 1000 brand new sofas or 300 pairs of skis without running a business, which may lead you to consider your trading status more carefully...

100% agree! Especially as it seems eBay appears to have a certain type of 'stupid' not found anywhere else that think buying from car boots, charity shops and Facebook to sell on here for more money doesn't constitute a business and doesn't make them traders.

In all seriousness though it would simplify things for hobby sellers, very small businesses etc. by taking away the need for filing an assessment.

They'd have the option to do so of course (to fully offset expenses) but I reckon a fair few would be happy with that arrangement as hassle free.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 10:42 AM

It's astonishing how many people don't realise that you can be an individual and be a business, they seem to think that the only businesses are limited companies. They have clearly never heard of the concept of 'sole trader'!

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 1:07 PM

EBay really don't help either. I've just filled in a 'how are we doing' survey on my private account. Some of the questions are asking how eBay is helping me to meet my legal obligations, then the last question - How do describe your selling on this account: Business, Private side hustle, or Other!

obviously I chose 'other' and stated Private account selling off own unwanted items.

Sorry, is it me? according to the law and eBays rules that's all a private account is supposed to be used for!

People illegally trading are probably reading that last one as; well it must be ok as eBay seem aware and are asking me if that's what I use it for....

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 2:31 PM

Or ebay interperts 'private side hustle' as (incorrectly) being private selling. The term side hustle seems to cause confusion. There's business or there's private nothing else.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 3:18 PM

Can anyone verify any success in reporting a private seller as a business seller and seeing their account change or listings be removed?

Ive reported about 10 accounts the past few months, all still going as Private, clearly businesses.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 4:41 PM

Exactly the same here except the last three didn't even warrant eBay's "We looked into your report and didn’t find the listing to be in violation of our policy." rapid response. Obviously they are not even bothering to respond to the issue now. For info. the last one had sold over 300 new items on one multi-variation listing alone and was running at least two accounts.

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 5:30 PM

Just adding more info for context.

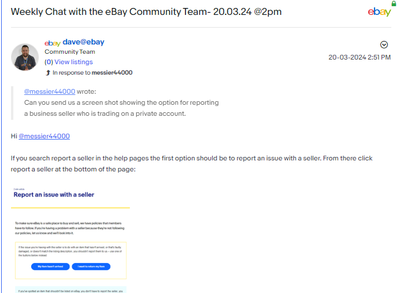

You asked during one of the weekly chats how to report an account that you believed was a business on a private account. I replied with the steps and screenshots you requested:

This was the same answer you received when you asked Anita. I did say there isn't a specific topic for that issue but reporting that subject was covered in the steps that I provided for you:

Thanks,

Dave

Who is right - (Private) business sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Highlight

- Report Inappropriate Content

11-04-2024 5:37 PM

Nothing happens when you do follow your screenshot for reporting business sellers on private accounst.

It is not fit for purpose and just a waste of everyones time and effort.